Two-thirds of export cargo through Greater Odessa ports are agricultural products

Half a year of operation of the sea corridor has shown that Ukrainian exporters of the agro-industrial complex and the steel sector can very well count on faster and cheaper (in relation to European ports) cargo transportation through the ports of Greater Odessa (Odesa, Chornomorsk and Pivdenniy ). This logistics route is under constant threat from missiles and drones, but judging by the statistics on exports through ports, cargo carriers are ready to take this risk. Another problem is the limited capacity of railway and port infrastructures, which since October last year has resulted in queues of freight wagons at railway stations, with an average waiting time of 5 to 7 days for unloading.

Runner's performance

Before the war, port logistics were the most widespread and accessible – more than 70% of Ukrainian export cargo was transported through ports. The opening, last August, of the temporary maritime corridor had a huge positive impact on opportunities for exporters of cereals, oilseeds and iron and steel cargoes and, therefore, for the entire country's economy.

On August 10 last year, the Ukrainian Navy announced temporary routes for commercial ships. The first to use this route were ships that were blocked in seaports after the outbreak of war. Since September 16, the temporary corridor has been open for ships arriving in search of Ukrainian exports. Around the beginning of November 2023, import cargoes began arriving at Greater Odessa ports.

In 2023, 430 ships were accepted for loading through the corridor, 400 ships departed from Ukrainian ports, exporting 12.8 million tons of cargo. The corridor made it possible to increase cargo transshipment in Ukrainian ports by 5% year on year at the end of last year – up to 62 million tons, although of all seaports in the Odessa region, only Odessa showed an increase in transshipment by 9% in 2023, to 8.4 million tons.

In just six months of the corridor's operation (as of February 13), 736 ships left the ports of Greater Odessa, which transported almost 23 million tons of export cargo, of which more than 2/3 were agro-products. It is obvious that in the work of the maritime corridor, the shipment of grains is prioritized, which restricts the export of other goods.

«More than 22 million tons in six months is not the limit. The modernization of the ports themselves and related infrastructure – the road and railway network – with an adequate security component will make it possible to increase volumes by at least a quarter,” notes Oleksandr Kubrakov, Deputy Prime Minister for Ukraine's recovery.

Iron exports

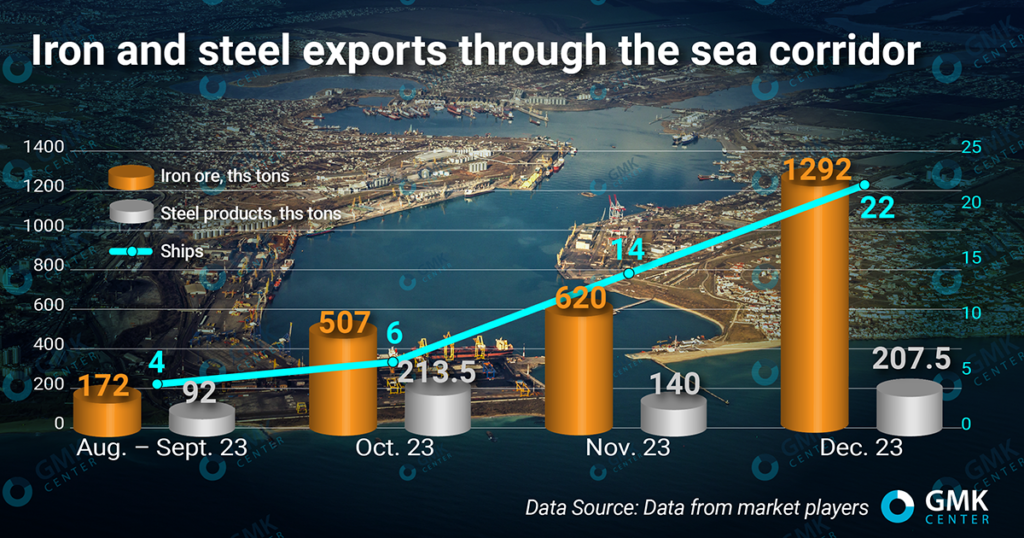

Steel products represent the second largest share of total exports through the maritime corridor. According to Compraço estimates, in August-December last year, at least 46 ships – 17 bulk carriers with 2.6 million tons of iron ore and 29 ships with 653 thousand tons of steel products – left the ports of Odessa and Yuzhny with iron and steel charges. This number includes the bulk carriers Primus, Anna Theresa, Ocean Courtesy and Puma, blocked in ports since February 24, 2022, and which left ports in August-September.

As the maritime corridor operated, the number of departures of ships carrying iron and steel export products also increased – from four in August-September last year to 22 in December. In particular, in December, 13 ships with 157.5 thousand tons of steel products left the port of Odessa, eight bulk carriers with 1.29 million tons of iron ore and one ship with 50 thousand tons of steel products left the port of Yuzhny.

Iron ore is exported exclusively by large-capacity bulk carriers from Yuzhny. Overall, the share of iron ore exports in total exports of raw materials through Greater Odessa ports reached 31.6% in November and 80.2% in December.

Steel products are exported in smaller shipments, mainly from the Port of Odessa. The export volume of steel products is still limited to 140-215 thousand tons, which is due to both the production capacity of companies and logistical restrictions.

Export interruptions

After the first positive results from the operation of the maritime corridor around the beginning of October last year, the flow of cargo towards the ports of Greater Odessa increased sharply. According to data from the Ukrainian Railways (UZ), in November-December 2023, a record monthly volume of loading of all types of cargo towards ports was recorded – more than 3.5 million tons per month (mainly grain and iron and steel cargo). In December last year, grain shipments to ports increased by 30% compared to November – to 2.14 million tons, iron ore – 20% m/m, to 1.53 million tons, ferrous metals – 5.3% m/m, to 276 thousand tons.

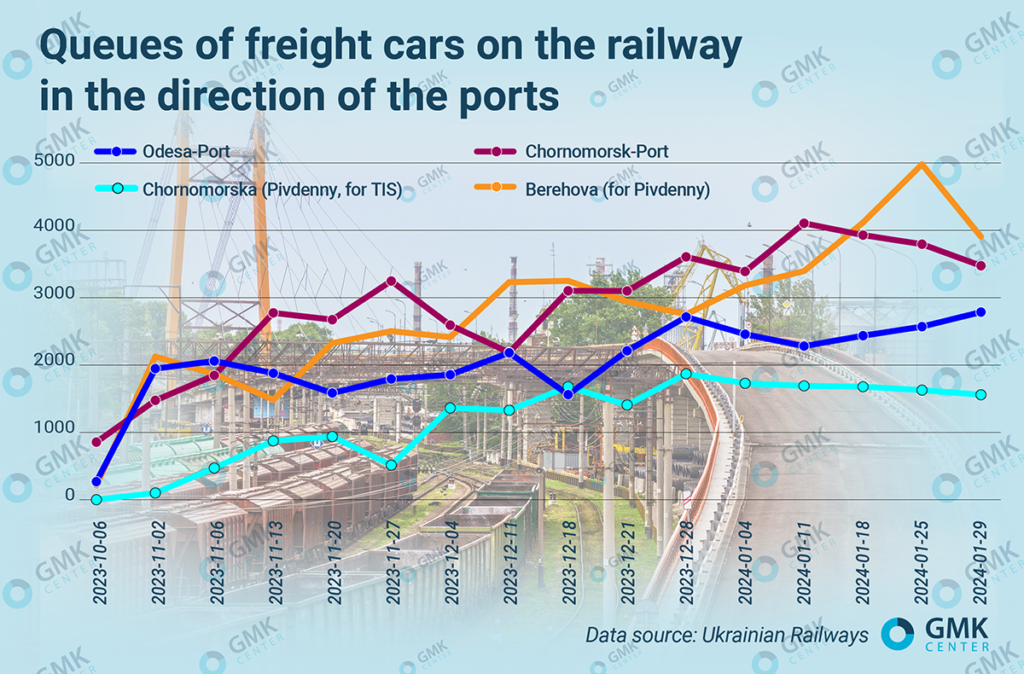

Due to the sharp increase in rail freight traffic, the operation of railway stations and ports began to suffer disruptions, which inevitably led to the accumulation of wagons for unloading at port stations.

At railway stations near the ports of Odessa and Chornomorsk, wagon congestion in November-December last year ranged between 1.5-2.7 thousand and 2.6-3.6 thousand units, respectively. In the port of Yuzhny, the queue was in the region of 1.4-1.8 thousand wagons. The waiting time for wagons to unload was on average 5 to 7 days. By mid-January 2024, the situation at Chornomorsk-Port and Beregova stations had worsened significantly, with more than 4,000 railcars piled up. At the same time, the launch of the corridor has eased pressure on the port of Izmail, where the queue has decreased from more than 4 thousand cars at the beginning of October 2023 to 1.5-1.8 thousand cars.

The accumulation of wagons at port stations was caused by:

- Limited transfer capacity of the Ukrainian Railways infrastructure and, as a consequence, overloaded direction to seaports. The bottleneck is located on one of the sections of the Odessa railway, the capacity of which is 49 pairs of freight trains per day.

- Increased number of missile and drone threats. In November, traffic towards the port of Izmail was interrupted for almost two days. During an air alert, the ship's cargo movement is stopped (port personnel go to bomb shelters), so the loading duration increased by 30% on average.

- At the end of November, due to heavy snowfalls, freezing and power cuts in the Odessa region, cargo movement in Greater Odessa ports and cargo delivery by rail became more complicated.

- In November, the railway was undergoing repair work, which partially complicated the movement of freight trains towards the ports of Greater Odessa.

- In October 2023, problems occurred with the shipment of cereals for export – authorities carried out searches and checks of accompanying documents as part of an investigation into illegal cereal export schemes. This was also related to the NBU's statement that exporters in the agro-industrial complex had not returned approximately $8 billion in revenue to Ukraine. The solution to the problem of illegal grain exports was the creation of an AIC list of verified entities that export grains and oilseeds.

The main of the above-mentioned problems is the limited capacity of the Ukrainian Railways infrastructure, which reduces the capacity to deliver cargo by rail to ports in the Odessa region and to remove empty wagons.

«In fact, this bottleneck limits all exports along the maritime corridor. The capacity of existing seaports and their terminals can handle twice as much, around 100 pairs of trains per day. Furthermore, not only grain cargoes, but also iron ore and metals share the capacity of this section. Therefore, exporters are limited in their ability to ship products for export», says Yuriy Shchuklin, owner of Vantage+, member of the European Business Association's Logistics Committee.

Safety problems

The security of the maritime corridor remains precarious. The good news is that the process of forming a coalition to demine the Black Sea has progressed – on January 11, Turkey, Bulgaria and Romania signed a memorandum. Practical implementation of the document may begin as early as April-May. These actions will help reduce the threat of mines to Black Sea shipping.

The security situation can be improved by convoying commercial ships with warships. At the end of November last year, President Volodymyr Zelenskiy said that Ukraine had agreed with its partners to obtain warships to transport ships in the maritime corridor.

At the same time, threats from mines and drone missiles to maritime and port infrastructure remain relevant. Since the end of the grain deal in July last year, Ukrainian ports have been hit by more than 30 combined attacks, resulting in the deaths of five port workers. In total, almost 200 port infrastructure facilities and seven commercial ships were damaged. Damage amounts to at least 1 billion UAH. The increase in insurance rates associated with these risks affects all cargo owners operating in the Black Sea; the cost of insurance severely limits the volume and frequency of transportation.

Therefore, the safety of ships using the maritime corridor is still not sufficiently guaranteed. At this time the situation appears to be under control, allowing commercial cargo ships to move in both directions, but threats still exist.

Impact on the economy

The maritime corridor solves a significant part of the problems of Ukrainian exporters, first of all – the agro-industrial complex and steel companies. Export through the seaports of Greater Odessa makes it possible to reduce logistics costs for Ukrainian exporters, which positively affects their financial and production indicators.

Ukrainian seaports are not fully loaded and are capable of increasing export transshipment, the main problems remain security and increasing the capacity of the railway infrastructure. It is also important to expand the use of insurance mechanisms for cargo transportation along the maritime corridor.

«In the last days of January, among all the ships moving to the ports of Greater Odessa, there was one ship that was insured against military risks thanks to UNITY insurance created by the Ukrainian government together with a pool of insurers led by Ascot. The insurance cost was 0.75% of the value of the vessel. More than a dozen insurance claims are in progress. The normalization of the insurance market in trade is a pillar for the resumption of value-added exports. This is why it is so important for us that insurance becomes more accessible and is already being used to export Ukrainian products». emphasizes Yulia Sviridenko, First Deputy Prime Minister and Minister of Economy of Ukraine.

Currently, priority in exports through the maritime corridor is given to grain cargo. In turn, steel companies are willing to increase exports through ports.

“We hope that by the end of the first quarter of 2024 iron ore exports by sea will reach their maximum – 2-3 million tons per month for all Ukrainian producers. Before the war, Metinvest alone delivered a maximum of 2 million tons of ore per month. However, there is still potential for expansion of other types of products from Ukrainian exporters: metals, coal, cement», Yuriy Ryzhenkov, CEO of Metinvest Group, said earlier.

The continued operation of the maritime corridor will have a positive impact on the entire economy. According to Dragon Capital estimates (as of October 2023), it could increase export revenues by 9-10 billion dollars and support GDP growth up to 5 pp in 2024. The Ministry of Economy estimates the economic effect is more modest – an increase in exports of at least 3.3 billion dollars and 1.23 pp of additional GDP growth.

«In 2024, average monthly shipments of goods through the new maritime corridor are expected to be around 7 million tons, of which 4 million tons will be food. This will support agriculture, industry, transport and wholesale trade,” the NBU said. he said .