Cryptocurrency is a huge opportunity for a startup that wants to make the most of blockchain technology, and getting started is really easy.

At first glance, it seems that entering the crypto market after 2022 would be irrational. We've seen some of the biggest names in the business freeze their assets, close their doors and collapse like a meteorite. But where there is crisis, there is also opportunity.

Cryptocurrency, or cryptography, is an innovative technology that has existed since 2009, the basis of which dates back to at least 1983. It is a decentralized form of currency that relies on a digital ledger (known as blockchain) to track the transaction and ownership of each unit .

Calling the crypto market a complex and complicated system would be an understatement. There's so much going on behind the scenes that an entire book wouldn't be enough to cover all the basics. Fortunately, you don't need a PhD. to create a cryptocurrency token or application. In fact, even creating your own cryptocurrency is actually a very simple process . But should you?

Why Blockchain technology and cryptocurrencies?

With a fluctuating market, distrust of cryptography (anything related to Web 3.0), and genuine concern about blockchain energy costs, it seems like this isn't the best time to get involved. But, everything that's happening is actually a very good thing. Listen to me.

The bad reputation cryptocurrency is getting is not a byproduct of the technology itself, but rather the get-rich-quick culture that surrounds it. Some readers may be too young to remember, but those of us who were there to see the rise of the world wide web remember the dot-com bubble and the crash that followed in the late 1990s.

In short, thanks to the low interest rates of the 1980s, we saw an exponential growth in startups. Many of the new companies saw an opportunity in a disruptive technology called the Internet. This translated into a massive increase in e-commerce and, for many companies, this was their catapult to success (Amazon, for example). Many others died, unable to become profitable in a market that was beyond saturated.

On top of that, we saw everything from impossible promises (at least at the time) to scams and poorly defined projects. Sound familiar? New technologies bring dreamers and opportunists who trust in the potential of technology to sell a possibility, a dream, a mirage.

But such grandiose promises are unsustainable in the long term, and the inevitable crash ultimately separates the wheat from the chaff. The dot-com craze gave us PayPal, Google, Amazon and dozens of companies that grew far beyond their initial idea.

Cryptocurrency is going through its painful adolescence, and that's a good thing, as these changes are necessary for the market to grow. mature and grow . There are many reasons to be cautiously optimistic about the future to come.

How to Make Your Own Blockchain and Create a Cryptocurrency the Easy Way

There are many approaches that can be taken to build a cryptocurrency. The history of Bitcoin is a testament to how complicated and complex it can be. Fortunately, thanks to the growing popularity of technology, the process has been simplified to the point that you can boil it down to seven steps:

#1 Define your goals.

The first step is to determine why you want to create a cryptocurrency. Not everyone who starts a project like this is trying to topple Ethereum and Bitcoin as champions. Sometimes you want something small; for example, cryptos are great for building brand awareness by raising capital or as the basis for a rewards program.

Your objective will help you understand the scale of the project and choose the best approach in each of the following steps.

#2 Choose a consensus algorithm

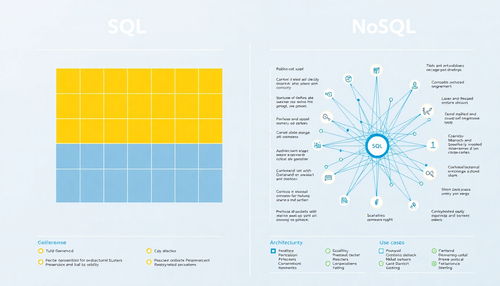

Decentralization is a central principle of cryptocurrencies. To maintain this decentralized structure, cryptocurrencies rely on consensus mechanisms to verify transactions on the blockchain.

Understanding the complexities of this mechanism is fundamental to understanding how cryptocurrencies operate within a secure and transparent blockchain architecture.

The two most prevalent consensus mechanisms are proof of work (PoW) and proof of stake (PoS). Each of these methods plays a key role in ensuring the validity and security of cryptocurrency transactions:

Proof of Work (PoW): In the PoW consensus mechanism, multiple participants, often called miners, participate in a competitive race to validate a transaction. They achieve this by performing complex cryptographic calculations. The first miner to successfully complete these calculations is rewarded with a token or coin for their diligent effort. PoW is known for its robust security features, making it a reliable choice for many cryptocurrency networks.

Proof of Stake (PoS): In contrast, the PoS consensus mechanism takes a different approach. Here, participants, known as validators, are required to commit a certain amount of cryptocurrency resources as a stake. The higher the stake amount, the more likely a validator will be chosen to confirm transactions and add new blocks to the blockchain. However, if a validator behaves dishonestly or makes mistakes, they risk losing their bet. PoS is praised for being environmentally friendly as it consumes significantly less energy compared to PoW.

Choosing between these two consensus mechanisms is a crucial decision for anyone involved in creating cryptocurrencies. While PoW is known for its robust security, PoS offers a more environmentally friendly and sustainable approach. However, there is no universally correct answer when it comes to selecting the most suitable consensus mechanism. The decision must be aligned with the objectives of your cryptocurrency and the goals you intend to achieve within the blockchain architecture.

#3 Choose a Blockchain platform.

Yes, you could build your own blockchain from scratch. But there are easier ways to create your own cryptocurrency. You could take the source code of an open source blockchain platform and use it as the basis for your own blockchain, or you could use existing blockchains.

Which blockchain to choose depends on your decision in the last step. Cardano and Polkadot are well-known proof-of-stake solutions. Ethereum, probably the most popular blockchain on the planet, is proof of work, but they are moving their operations to proof of stake.

#4 Create the nodes

Nodes are the computers that participate in the blockchain network. They run the software protocol, validate transactions, and keep the network secure.

You need to make a few choices at this stage: Will the nodes be public or private? Will you have them on-premises or in the cloud? How many nodes? What operating system will they run?

#5 Design the internal architecture

Now you have to build the internal architecture . This step is extremely important because once online, there is no going back. In addition to the technical aspect, you must make some important decisions regarding the accessibility and economy of your currency:

- Define who can access, create and validate new blocks;

- Create rules for issuing assets;

- Build a management system for protecting and storing private keys;

- Decide the number of digital signatures your blockchain will require to verify transactions;

- Estimate block reward, block size, transaction limits, etc.;

- Estimate how many coins you will offer.

#6 Generate a wallet address

Now that your nodes are live, you need to have an address so that people can interact with your network to buy or sell cryptocurrencies; this is your wallet address. You can generate it yourself or use a third party to create the address for you.

#7 Integrate APIs

While this step is optional, it's a good idea to think about an API for your cryptocurrency as it will allow your users to create new tools and interact with your network in creative ways. APIs are a fantastic way to build trust with a community of developers and technology enthusiasts.

Is it legal to create your own cryptocurrency?

The short answer is yes. The long answer: it's complicated.

Cryptocurrencies are in a gray area at the moment. Some countries accept them wholeheartedly, others accept only some, and some ban them completely. Depending on what you want to use your cryptocurrency for and your potential market, you may need to familiarize yourself with the legality of crypto.

Additionally, some companies offer a seal of approval for cryptocurrencies, a huge asset for any company trying to enter the crypto world. As long as you follow these steps and understand the laws that regulate your market, there is nothing to fear.

Cryptocurrency Use Cases

Cryptocurrencies have evolved beyond being just a digital alternative to traditional currencies. They serve a variety of practical purposes, each with unique benefits and applications. Understanding these use cases is crucial for anyone thinking about creating their own cryptocurrency. Let's explore some of the most prominent ones:

#1 Digital payments and peer-to-peer transactions

Cryptocurrencies were originally created to enable secure and decentralized peer-to-peer transactions without the need for intermediaries like banks. Bitcoin, the first cryptocurrency, paved the way for digital payments. Users can send funds across borders quickly and with lower transaction fees compared to traditional banking systems.

Real-world example: Bitcoin (BTC) remains the most used cryptocurrency for daily transactions. Many companies, both online and offline, accept Bitcoin as a payment method. For example, Overstock. com and Shopify allow customers to pay with Bitcoin for a variety of products.

#2 Cross-Border Shipments

Cryptocurrencies offer a cost-effective solution for international remittances. People working abroad can send money home to their families without the high fees associated with traditional remittance services. This use case is particularly valuable for individuals in regions with limited access to banking services.

Real-world example: Ripple's XRP is often used for international remittances. Companies like MoneyGram and Western Union have explored partnerships with Ripple to leverage its blockchain technology for faster and cheaper international money transfers.

#3 Decentralized Finance (DeFi)

DeFi is a growing sector in the cryptocurrency space, offering financial services without relying on traditional banks. DeFi platforms allow users to borrow, lend, trade and earn interest on their cryptocurrencies. This ecosystem is known for its openness and accessibility.

Real-world example: Compound Finance and Aave are popular DeFi platforms that allow users to earn interest by lending their cryptocurrencies or lending assets using their cryptocurrencies as collateral.

#4 Non-Fungible Tokens (NFTs)

NFTs represent ownership of unique digital assets and have gained immense popularity in the worlds of art, gaming, and entertainment. They are often used to prove ownership and authenticity of digital or physical items, including artwork, music, collectibles, and gaming assets.

Real-world example: Selling digital artworks as NFTs has taken the art world by storm. Artists like Beeple have sold NFT-based artwork for millions of dollars on platforms like OpenSea and Rarible.

#5 Smart Contracts

Smart contracts are self-executing contracts with the terms of the contract directly written into code. They automate processes and eliminate the need for intermediaries in various industries, including legal, insurance and supply chain management.

Real-world example: Ethereum is the leading platform for creating and executing smart contracts. Companies like Chainlink provide oracles that allow smart contracts to interact with real-world data, expanding their functionality.

#6 Privacy and security

Cryptocurrencies provide an additional layer of privacy and security for users who want to keep their financial transactions confidential. Privacy-focused cryptocurrencies offer enhanced anonymity features.

Real-world example: Monero (XMR) is a privacy-focused cryptocurrency that uses advanced cryptographic techniques to obfuscate transaction details, ensuring user privacy.

When creating a cryptocurrency, it is crucial to understand the different market use cases, including payments, decentralized finance (DeFi), NFTs, and more, to make informed decisions. Consider tailoring your cryptocurrency's features and capabilities to suit a specific purpose. This approach allows you to leverage existing blockchain infrastructure effectively.

The possibilities in the ever-evolving crypto space are wide open. By aligning your project with a specific use case, like DeFi or NFTs, you can innovate in this area and potentially drive more adoption. However, it is essential to navigate the legal aspects of creating cryptocurrencies while ensuring your cryptocurrency complies with relevant regulations.

As a blockchain developer embarking on the journey to create your own cryptocurrency, it is critical to understand the intricacies of cryptocurrency's legal requirements. You will need to stay informed about the latest developments and identify opportunities to provide real utility within the cryptocurrency you are developing.

With so many directions to explore, an insightful approach, combined with a deep understanding of existing blockchain infrastructure, cryptocurrency coin creation, and legal considerations, will be most useful when designing a new cryptocurrency.

How to make a cryptocurrency: summing up

Entering the cryptocurrency market and creating your own currency can be a worthwhile undertaking. Leaving aside the obvious advanced technical knowledge required, you need to be aware of the risks and steps involved before getting started. This will help ensure you enter the market fully informed and prepared.

If you liked this article, be sure to check out our other articles on Blockchain technology:

- Blockchain can be a strategic ally for healthcare. Here's why.

- Blockchain in Banking: A Game Changer for Financial Services

- How IoT, AI and Blockchain Lead the Way to a Smarter Energy Sector

- Is Blockchain a solution that waits to solve a problem?

- What is Blockchain and why does your company need it?

Common questions

Can creating a cryptocurrency be profitable in the long term?

Creating your own token can be profitable in the long run, but it is a risk. The success of creating cryptocurrencies depends on several factors, including market demand, the technology you use, and more. Before deciding to build cryptocurrency, you must evaluate the risks versus rewards.

What are some of the advantages and disadvantages of using an existing blockchain platform to create cryptocurrencies?

There are several advantages to using an existing blockchain platform to create a new cryptocurrency, such as stronger security, community, cost savings, and seamless integrations with related applications. However, there are also some disadvantages, including limited customization options, increased competition, dependence on the platform infrastructure and development team, and governance that can affect your decision-making capabilities.

What are the risks associated with creating a cryptocurrency and how can they be mitigated?

There are some risks associated with creating your own cryptocurrency. For example, there are regulatory risks. Organizations can resolve this by working with legal experts to ensure cryptocurrency compliance. Additionally, cryptocurrency can be vulnerable to cyberattacks. That's why it's important to work with cybersecurity experts first to rigorously test and evaluate the product.

What technical skills are needed to create a cryptocurrency?

Creating a cryptocurrency typically requires knowledge of blockchain technology, cryptography, smart contracts, and programming languages such as Solidity for Ethereum-based tokens or C++ for custom blockchain solutions.

Source: BairesDev