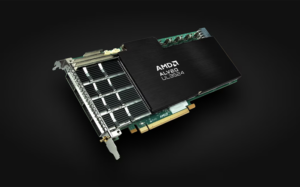

AMD announced the AMD Alveo UL3524 accelerator card, a new fintech accelerator designed for ultra-low latency electronic trading applications. Already deployed by leading trading firms and enabling multiple partner solution offerings, the Alveo UL3524 provides proprietary traders, market makers, hedge funds, brokers and exchanges with a state-of-the-art FPGA platform for electronic trading at nanosecond speeds (ns ). .

The Alveo UL3524 delivers a 7X latency improvement over previous generation FPGA technology, achieving less than 3ns of FPGA transceiver latency for accelerated trade execution. Powered by a custom 16nm Virtex UltraScale+ FPGA, it features a new transceiver architecture with optimized and hardened network connectivity cores to achieve breakthrough performance.

The Alveo UL3524 delivers a 7X latency improvement over previous generation FPGA technology, achieving less than 3ns of FPGA transceiver latency for accelerated trade execution. Powered by a custom 16nm Virtex UltraScale+ FPGA, it features a new transceiver architecture with optimized and hardened network connectivity cores to achieve breakthrough performance.

By combining hardware flexibility with ultra-low latency networking on a production platform, the Alveo UL3524 enables faster design closure and deployment compared to traditional FPGA alternatives.

“In ultra-low latency trading, a nanosecond can determine the difference between a profitable or losing trade,” said Hamid Salehi, director of product marketing at AMD. “The Alveo UL3524 accelerator card is powered by AMD’s lowest latency FPGA transceiver – purpose-built to give our fintech customers an unprecedented competitive advantage in the financial markets.”

AI-enabled trading strategies

Featuring 64 ultra-low latency transceivers, 780K FPGA fabric LUTs, and 1,680 compute DSP slices, the Alveo UL3524 is designed to accelerate custom trading algorithms in hardware, where traders can adapt their design to evolving strategies and market conditions.

Supported by traditional FPGA flows using the Vivado Design Suite, the product comes with a set of reference designs and performance benchmarks that enable FPGA designers to quickly explore key metrics and develop custom trading strategies to specifications, backed by Global support from AMD domain experts.

To streamline the growing adoption of AI in the algorithmic trading market, AMD is providing developers with the open-source, community-supported FINN development framework. By using PyTorch and neural network quantization techniques, the FINN project allows developers to reduce the size of AI models while maintaining accuracy, compiling to hardware IP, and integrating the network model into the algorithm datapath for improved performance. low latency. As an open source initiative, the solution offers developers flexibility and accessibility to the latest advances as projects evolve.

Ultra-low latency fintech solutions

The Alveo UL3524 and purpose-built FPGA technology are enabling strategic partners to build custom solutions and infrastructure for the fintech market. Currently available partner solutions include offerings from Alpha Data, Exegy and Hypertec.

The AMD Virtex UltraScale+ VU2P FPGA powering the Alveo UL3524 accelerator card is enabling ultra-low latency devices from Alpha Data.

“AMD’s new Virtex UltraScale+ FPGA brings a step change to ultra-low latency trading and networking,” said David Miller, managing director at Alpha Data. “We developed the ADA-R9100 rackmount device that allows customers to easily access the full potential of the new AMD FPGA device.”

Exegy, a provider of end-to-end front-office trading solutions, is supporting the Alveo UL3524 board with its nxFramework, a software and hardware development environment tailored to create and maintain ultra-low latency FPGA applications in the financial sector.

“By combining AMD's pioneering ultra-low latency FPGA technology with Exegy's expertise in capital markets, we are able to provide a comprehensive solution that addresses the ever-increasing optimization required to build tomorrow's commercial infrastructure,” said Olivier Cousin, director of FPGA solutions at Exegy.

Hypertec has optimized its ORION HF X410R-G6 high-frequency server for the Alveo UL3524 with a custom cooling system for deployment in a 1U server form factor.

“Hypertec engineers specifically designed the HF

The AMD Alveo UL3524 accelerator card is currently in production and shipping to global financial services customers.