-

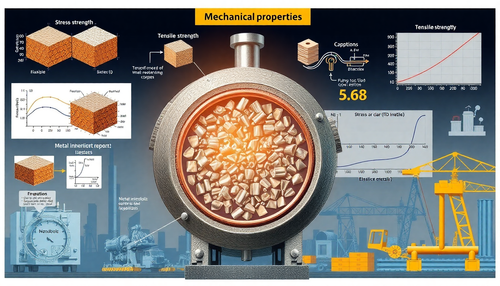

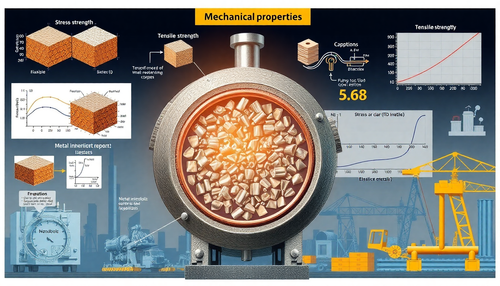

Propriedades Mecânicas dos Metais: Entendendo a Resistência e Durabilidade

Frequentemente, os materiais estão sujeitos a uma força externa quando são usados. Engenheiros mecânicos calculam essas forças, e cientistas de materiais determinam como os materiais se deformam ou...

-

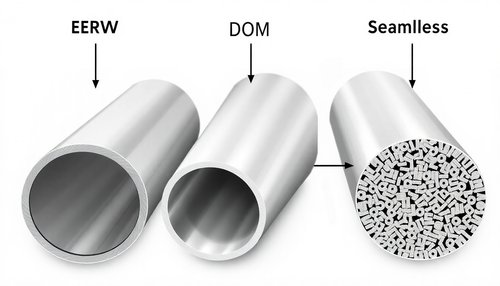

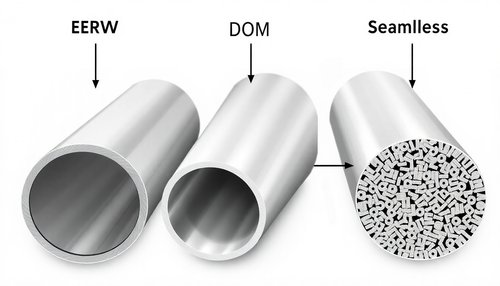

Entendendo os diferentes tipos de Tubos de Aço: ERW, DOM e Sem Costura

Este mês, examinamos as diferenças entre ERW, DOM e tubos sem costura. Tubos ERW (Electric Resistance Welded) ERW se refere a um processo de soldagem que envolve soldagem por pontos e por costura, ...

-

Como verificar a dureza do metal sem uma máquina Rockwell

Por muito tempo, pensei que a única maneira de verificar corretamente a dureza do metal era com uma máquina de teste Rockwell adequada. Felizmente, aprendi algumas outras técnicas simples e eficaze...

-

Curso com Planilhas Automáticas para Engenharia Civil

Planilhas Automáticas para Engenharia Civil: Cálculo e Dimensionamento Simplificados

Na engenharia civil, precisão e eficiência são vitais para o sucesso de qualquer projeto. No entanto, o process...

-

Curso de Power BI para Engenharia Civil

Power BI na Engenharia Civil: Da Introdução às Aplicações Avançadas

No cenário competitivo da engenharia civil e da construção, a capacidade de gerenciar e analisar dados se tornou uma habilidade ...

-

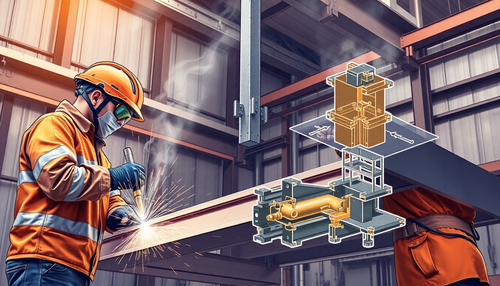

Cursos de Soldagem: Programa Completo para Iniciantes e Profissionais

Qualificação Profissional em Soldagem: Cursos Estratégicos para Atuar com Sucesso na Indústria

A soldagem é uma das habilidades mais críticas e requisitadas na indústria, especialmente em setores...

-

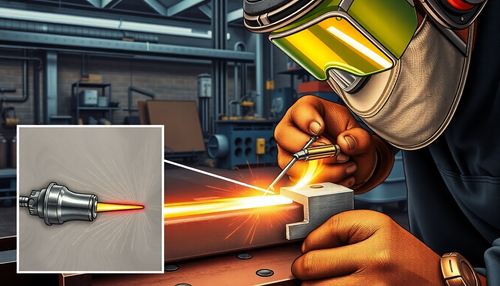

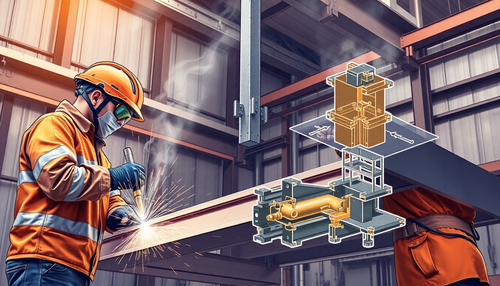

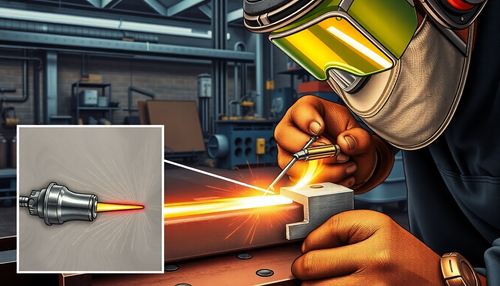

Como prolongar a Vida Útil do Bico de Contato na Solda MIG

A solda MIG (Metal Inert Gas) é uma técnica amplamente utilizada na indústria e construção devido à sua eficiência, versatilidade e qualidade dos resultados. No entanto, um componente crucial neste...

-

Como manter o Arco Elétrico Estável durante a Soldagem

A soldagem é uma técnica essencial em diversas indústrias, desde a construção civil até a fabricação de automóveis. No entanto, um dos desafios mais comuns enfrentados pelos soldadores é a manutenç...

-

Como Eliminar Respingos Excessivos na Soldagem MIG

A soldagem MIG (Metal Inert Gas) é uma técnica amplamente utilizada na indústria e construção, conhecida por sua eficiência e versatilidade. No entanto, um dos desafios comuns enfrentados pelos pro...

-

Como escolher o arame correto para solda MIG

A escolha do arame correto para solda MIG é fundamental para obter resultados de alta qualidade e eficiência no processo de soldagem. Cada tipo de arame possui características específicas que afeta...

-

Soldagem de Tubulações em Campo: Preparação e Sequenciamento

A soldagem de tubulações em campo é um desafio único que requer habilidades especializadas e planejamento cuidadoso. Diferente da soldagem em ambiente controlado de oficina, a soldagem em campo enf...

-

Soldagem em Peças Pintadas: Evitando Problemas e Garantindo Segurança

A soldagem é uma técnica fundamental em diversos setores industriais, desde a fabricação de automóveis até a construção civil. No entanto, quando se trata de soldar peças que já foram pintadas, é e...

-

Escovas de Aço na Soldagem: Preparação e Acabamento Perfeitos

A soldagem é uma técnica fundamental em diversas indústrias, desde a construção civil até a fabricação de maquinário pesado. No entanto, para obter resultados de alta qualidade, é essencial prepara...

-

Entendendo o Processo de Brasagem: Quando e Como Utilizá-lo

A brasagem é uma técnica de união de metais que se diferencia da solda tradicional por fusão. Enquanto a solda envolve o derretimento e a mistura dos metais, a brasagem utiliza uma liga de metal de...

-

Importância da Limpeza Pós-Soldagem em Aço Inox e Alumínio

A soldagem é uma técnica fundamental em diversos setores industriais, desde a construção civil até a fabricação de equipamentos. No entanto, após o processo de soldagem, é essencial realizar uma li...

-

Identificando e Corrigindo a Falta de Penetração na Solda

A integridade estrutural de uma junta soldada depende crucialmente da qualidade da penetração da solda. Quando a penetração é insuficiente, a resistência da união fica comprometida, podendo levar a...

-

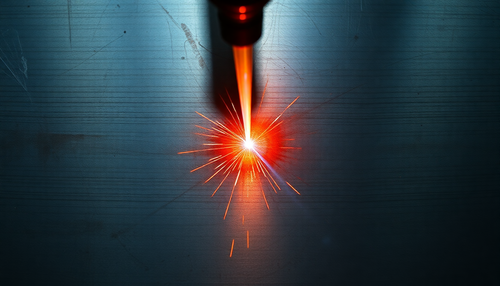

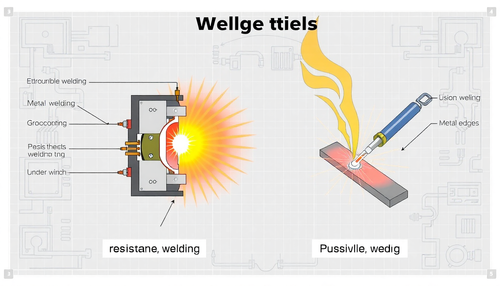

Processo de Soldagem por Resistência Elétrica: Entendendo os Detalhes Técnicos

A soldagem por resistência elétrica, também conhecida como solda por ponto ou spot weld, é uma técnica amplamente utilizada na indústria, especialmente na fabricação de automóveis e estruturas metá...

-

Soldagem em Aço Inoxidável: Evitando os Erros Mais Comuns

A soldagem de aço inoxidável é uma tarefa delicada que requer atenção aos mínimos detalhes. Diferente da soldagem de aços carbono, o processo de união de peças em aço inoxidável envolve desafios es...

-

Importância do Controle da Velocidade de Avanço na Soldagem

A soldagem é uma técnica fundamental em diversas indústrias, desde a construção civil até a fabricação de automóveis. No entanto, para obter resultados de alta qualidade, é essencial dominar divers...

-

Soldagem de Titânio: Superando Desafios e Impulsionando a Inovação

O titânio é um material fascinante, conhecido por sua resistência, leveza e biocompatibilidade. No entanto, a soldagem desse metal nobre apresenta desafios únicos que exigem técnicas especializadas...

-

Como usar gabaritos e fixações para garantir soldagens precisas

A precisão é fundamental quando se trata de soldagem. Peças mal alinhadas ou deslocadas podem resultar em juntas defeituosas, reduzindo a integridade estrutural e a aparência final do trabalho. Fel...

-

Técnicas Essenciais de Ponteamento para Montagem de Estruturas Metálicas

A montagem de estruturas metálicas é uma etapa crucial no processo de construção, exigindo técnicas precisas e cuidadosas para garantir a estabilidade e o alinhamento adequado das peças. Uma das té...

-

Poça de Fusão: Técnicas Essenciais para Soldagem TIG Perfeita

A soldagem TIG (Tungsten Inert Gas) é uma técnica versátil e precisa, amplamente utilizada na indústria e construção. No entanto, manter a poça de fusão sob controle pode ser um desafio, especialme...

-

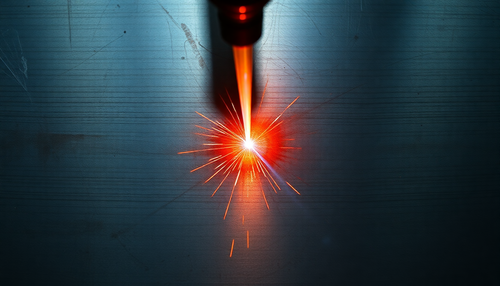

Soldagem a Plasma: Tecnologia para a Indústria e Construção

A soldagem a plasma, também conhecida como PAW (Plasma Arc Welding), é uma técnica de soldagem avançada que vem revolucionando a indústria e a construção. Essa tecnologia oferece uma solução eficie...

-

Importância do Martelo de Escória na Soldagem com Eletrodo Revestido

A soldagem com eletrodo revestido é uma técnica amplamente utilizada na indústria e construção civil, sendo essencial para a união de metais e a fabricação de estruturas robustas. No entanto, o pro...

-

Como fazer uma Solda Filetada com Qualidade Profissional

A solda filetada, também conhecida como solda em ângulo, é uma técnica amplamente utilizada na indústria e na construção civil para unir peças metálicas em ângulo. Essa técnica é essencial para a f...

-

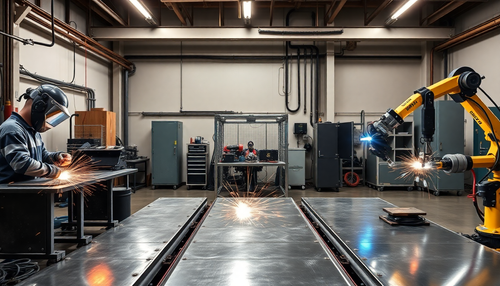

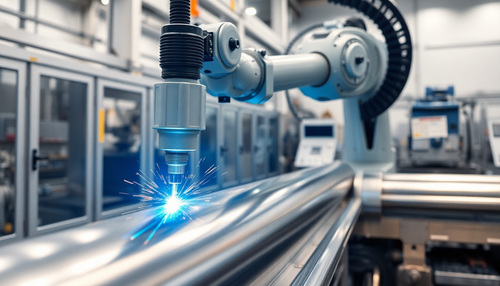

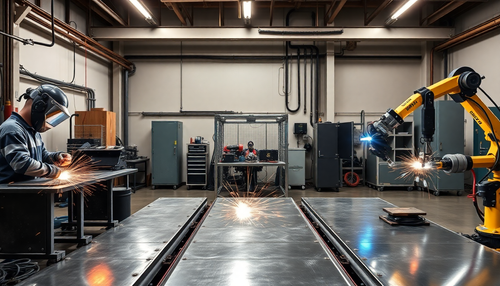

Entendendo os Tipos de Soldagem: Manual, Semiautomática e Automática

A soldagem é uma técnica fundamental em diversos setores industriais, desde a fabricação de automóveis até a construção civil. No entanto, nem todas as técnicas de soldagem são iguais. Existem três...

-

Entendendo a Escorificação na Soldagem: Causas, Impactos e Soluções

A soldagem é uma técnica fundamental em diversos setores industriais, desde a construção civil até a fabricação de máquinas e equipamentos. No entanto, durante o processo de soldagem, um fenômeno i...

-

Diferença entre solda TIG DC e TIG AC: quando usar cada uma

A solda TIG (Tungsten Inert Gas) é uma técnica amplamente utilizada na indústria e construção, conhecida por sua precisão, qualidade e versatilidade. No entanto, existem duas variantes principais d...

-

Soldagem em Aço Carbono Espesso: Desafios e Soluções

A soldagem de aço carbono espesso é um desafio constante para profissionais da indústria e construção. Essas peças exigem cuidados especiais durante o processo de soldagem, a fim de garantir a inte...

-

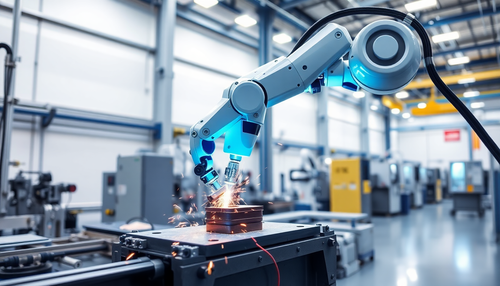

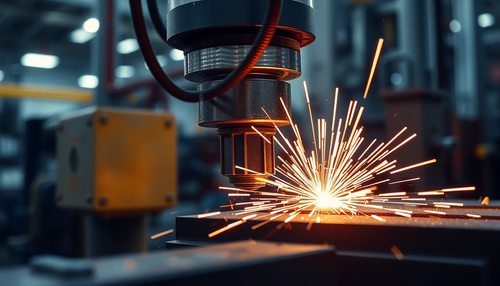

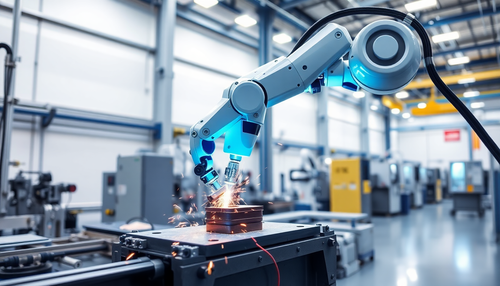

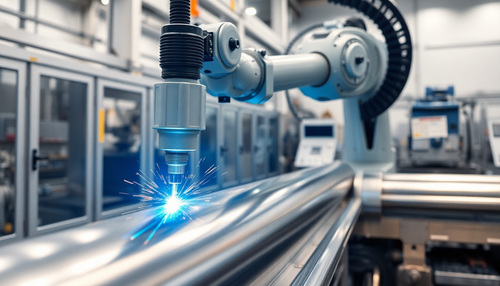

Como a Soldagem Robotizada Transforma a Indústria

A evolução tecnológica tem impulsionado transformações significativas em diversos setores industriais, e a soldagem robotizada é um exemplo claro dessa realidade. Essa técnica avançada vem se conso...

-

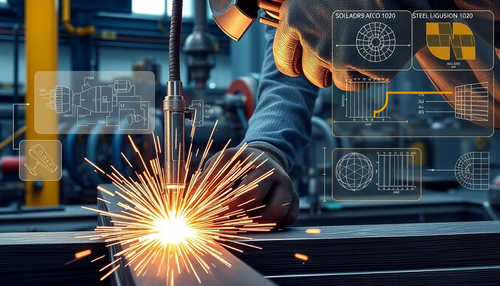

Soldar Aço 1020 corretamente: Evite trincas e Garanta Qualidade

O aço SAE AISI 1020 é um dos materiais mais utilizados na indústria e construção civil devido à sua versatilidade e custo-benefício. Esse aço carbono de baixa liga é amplamente empregado em estrutu...

-

Como Soldar Aço Inox com TIG Sem Contaminação: Um Guia Passo a Passo

A soldagem de aço inoxidável é uma tarefa delicada que requer atenção especial para evitar contaminação e obter um acabamento limpo e profissional. A técnica de soldagem TIG (Tungsten Inert Gas) é ...

-

Como identificar e utilizar o Eletrodo 6013

O eletrodo 6013 é um dos tipos mais comuns e versáteis de eletrodos de soldagem utilizados na indústria e construção civil. Sua popularidade se deve às suas características únicas, que o tornam ide...

-

Como fazer uma Solda no Eletrodo Revestido

A solda com eletrodo revestido é uma técnica amplamente utilizada na indústria e construção civil devido à sua versatilidade e facilidade de aplicação. Neste artigo, vamos explorar detalhadamente o...

-

Garantia de Qualidade em Soldas: Os Principais Testes Não Destrutivos

A integridade e a qualidade das soldas são fundamentais em diversos setores industriais, desde a construção civil até a fabricação de equipamentos de alta tecnologia. Para assegurar que as juntas s...

-

Como ajustar Corretamente a Amperagem na Solda com Eletrodo Revestido

A solda com eletrodo revestido é uma técnica amplamente utilizada na indústria e construção, sendo essencial para a união de peças metálicas. Um dos fatores críticos neste processo é o ajuste preci...

-

Equipamentos de Proteção Individual (EPIs) obrigatórios para Soldadores

A segurança é um fator primordial no ambiente de trabalho, especialmente para profissionais que lidam com atividades de alto risco, como a soldagem. Os Equipamentos de Proteção Individual (EPIs) sã...

-

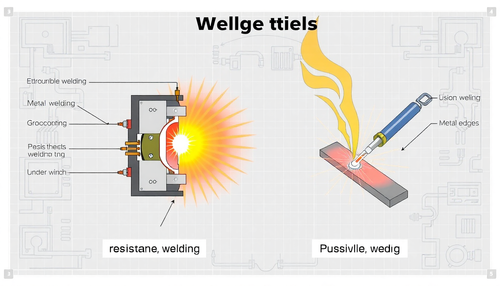

Diferença entre Solda por Resistência e Solda por Fusão: Aplicações Práticas

A escolha do processo de soldagem correto é crucial para garantir a integridade e a eficiência de diversas aplicações industriais, desde a fabricação de automóveis até a construção de aeronaves. Ne...

-

A Soldagem Orbital: Precisão e Eficiência

A soldagem orbital é uma técnica revolucionária que está transformando a maneira como as indústrias abordam a união de materiais. Essa abordagem automatizada e precisa tem se destacado em diversos ...

-

Como Regular sua Inversora MIG para Chapas Finas

A solda MIG (Metal Inert Gas) é uma técnica amplamente utilizada na indústria e construção, conhecida por sua versatilidade e eficiência. No entanto, quando se trata de trabalhar com chapas finas, ...

-

5 Erros Comuns na Soldagem com Alumínio

A soldagem de alumínio é uma técnica desafiadora que requer atenção aos detalhes e conhecimento especializado. Infelizmente, muitos profissionais cometem erros comuns que podem comprometer a qualid...

-

Como Prevenir Trincas a Quente e a Frio em Soldas

A soldagem é uma técnica fundamental na indústria e construção, permitindo a união de peças metálicas de forma eficiente e resistente. No entanto, um desafio comum enfrentado pelos profissionais é ...

-

Soldagem com Arame Tubular: Praticidade, Penetração e Produtividade

A soldagem com arame tubular, também conhecida como FCAW (Flux-Cored Arc Welding), é um processo de soldagem amplamente utilizado na indústria e na construção civil. Essa técnica combina a praticid...

-

Diferença entre Solda Forte e Solda Branda

A escolha entre solda forte e solda branda é uma decisão crucial para muitos profissionais da indústria e construção. Cada uma dessas técnicas de união possui características únicas que as tornam a...

-

Soldagem por Fricção: Junção de Metais Leves

A indústria moderna enfrenta constantes desafios na busca por soluções de fabricação cada vez mais eficientes e sustentáveis. Nesse cenário, a técnica de soldagem por fricção (FSW - Friction Stir W...

-

Soldagem em Campo: Desafios e Soluções para Ambientes Adversos

A soldagem é uma técnica essencial em diversos setores industriais, desde a construção civil até a fabricação de equipamentos. No entanto, quando a soldagem precisa ser realizada fora do ambiente c...

-

Soldagem por Arco Submerso: Eficiência e Versatilidade na Indústria

A soldagem por arco submerso (SAW) é uma técnica amplamente utilizada na indústria, conhecida por sua alta taxa de deposição e capacidade de soldar chapas grossas e estruturas pesadas. Este process...

-

A Solda de Tampão: Unindo Chapas com Eficiência e Resistência

A solda de tampão, também conhecida como solda de pino ou solda de ponto, é uma técnica amplamente utilizada na indústria e na construção civil para unir chapas sobrepostas de maneira rápida, efici...

-

Como obter um Acabamento Perfeito na Solda com Esmerilhamento Correto

Na indústria e construção, o acabamento superficial da solda é um fator crucial para a aparência final e a integridade estrutural de um projeto. Um acabamento mal feito pode comprometer a resistênc...

-

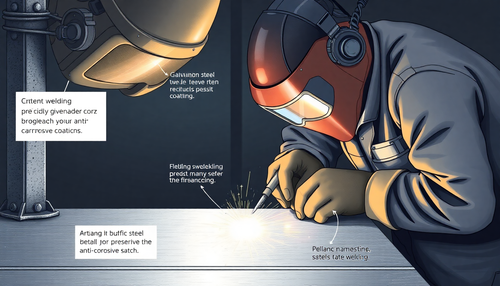

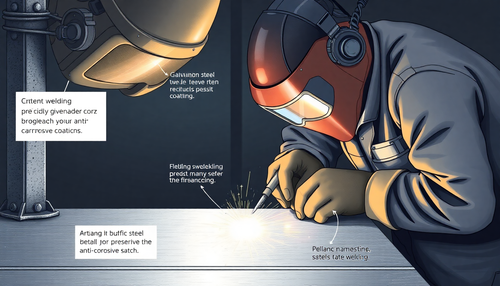

Como Soldar Aço Galvanizado sem comprometer a Proteção Anticorrosiva

A solda é uma técnica essencial na indústria e construção, permitindo a união de peças metálicas de forma segura e eficiente. No entanto, quando se trata de soldar aço galvanizado, existem desafios...

-

A Soldagem por Feixe de Elétrons: Técnica Avançada para Unir Metais com Precisão

A soldagem por feixe de elétrons (EBW) é uma técnica avançada de união de metais que utiliza um feixe de elétrons acelerados em uma câmara de vácuo para fundir e soldar materiais com precisão milim...

-

Soldagem em Tubulações: Desafios e Técnicas Essenciais

A soldagem em tubulações é uma tarefa crítica na indústria e construção, exigindo habilidades especializadas e técnicas avançadas. Neste artigo, exploraremos os desafios técnicos envolvidos nesse t...

-

Como o ângulo da tocha afeta a solda MIG

A solda MIG (Soldagem por Gás de Metal) é uma técnica amplamente utilizada na indústria e construção, conhecida por sua eficiência e versatilidade. Um dos fatores-chave que influenciam diretamente ...

-

Soldagem em Alumínio: Principais cuidados e Técnicas Recomendadas

O alumínio é um material amplamente utilizado na indústria e na construção civil devido às suas propriedades únicas, como leveza, resistência à corrosão e alta condutividade elétrica e térmica. No ...

-

Como lidar com Rachaduras na Solda ao Resfriar o Cordão

A soldagem é uma técnica fundamental na indústria e construção, permitindo a união de peças metálicas de forma eficiente e resistente. No entanto, um desafio comum que os profissionais enfrentam é ...

-

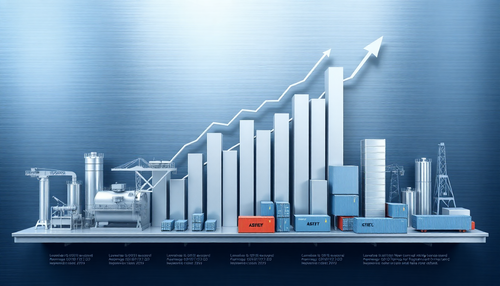

Tarifa temporária de 12% da Índia sobre importações de aço

Em 21 de abril de 2025, o governo da Índia anunciou a implementação de uma tarifa temporária de 12% sobre as importações de aço no país. Esta medida visa proteger a indústria siderúrgica doméstica ...

-

Produção brasileira de aço bruto cresce 6,6% em março de 2025

A indústria siderúrgica brasileira apresentou resultados animadores no primeiro trimestre de 2025. Segundo dados divulgados pelo Aço Brasil, a produção de aço bruto no país em março alcançou 2,944 ...

-

Queda contínua da Confiança da Indústria do Aço no Brasil

A indústria do aço no Brasil enfrenta um cenário de cautela e incertezas, com o Indicador de Confiança da Indústria do Aço (ICIA) caindo pelo sexto mês consecutivo em abril, atingindo 31,6 pontos. ...

-

Exportações brasileiras de aço para os EUA crescem apesar das tarifas

Mesmo com a sobretaxa de 25% imposta pelos EUA, as exportações brasileiras de aço e automóveis para o mercado norte-americano cresceram até 20,5% no primeiro trimestre de 2025, mostrando a resiliên...

-

Notícias do Setor Siderúrgico: Recordes, Preços e Exportações

O setor siderúrgico global continua a apresentar movimentações significativas, com destaque para alguns fatos recentes que impactam diretamente o mercado internacional de aço. Vamos analisar alguma...

-

Ibovespa acelera alta e dólar cai com guerra comercial em foco

O mercado financeiro brasileiro registrou uma sessão positiva nesta segunda-feira (17), com o Ibovespa, principal índice da B3, subindo 0,93% e chegando a 129.507 pontos. Ao mesmo tempo, o dólar à ...

-

Big Techs perdem mais de 10% após o anúncio do 'Tarifaço' dos EUA

As principais empresas de tecnologia dos Estados Unidos, conhecidas como "Big Techs", registraram quedas superiores a 10% em suas ações desde o anúncio do aumento das tarifas comerciais pelo govern...

-

Mercado financeiro eleva previsão para expansão da economia brasileira em 2025

O cenário econômico brasileiro tem sido alvo de constante atenção e análise por parte dos especialistas do mercado financeiro. Recentemente, o Boletim Focus do Banco Central do Brasil elevou a prev...

-

Banco Central Europeu reduz juros e alerta para incertezas em meio a tarifas

O Banco Central Europeu (BCE) anunciou mais um corte na taxa básica de juros, a sétima redução em um ano, em uma tentativa de sustentar a economia da zona do euro diante das incertezas geradas pela...

-

Economia global sob pressão pode desacelerar para 2,3%, sinaliza ONU

A economia global enfrenta uma conjuntura desafiadora, com incertezas que podem levar a uma desaceleração do crescimento para apenas 2,3% em 2025, de acordo com as projeções da Organização das Naçõ...

-

Petrobras anuncia redução no preço do diesel para distribuidoras

A Petrobras, a maior empresa de energia do Brasil, anunciou hoje uma redução no preço do diesel para as distribuidoras a partir de amanhã. Essa medida vem em um momento crucial para a economia bras...

-

China lança Pacote de Estímulos para Estabilizar Produção Siderúrgica

O governo chinês anunciou recentemente um pacote de medidas para apoiar a indústria siderúrgica do país, visando estabilizar a produção e manter os empregos no setor. Essa iniciativa surge em meio ...

-

Exportações brasileiras de minério de ferro crescem 5% em março, diz Vale

As exportações brasileiras de minério de ferro registraram um aumento de 5% em março de 2025, de acordo com os dados divulgados pela Vale, uma das principais mineradoras do país. Esse crescimento r...

-

Aço Inoxidável em Alta: Entenda o Crescimento da Demanda no Mercado Brasileiro

Em 2025, o mercado brasileiro de aço inoxidável experimentou um crescimento significativo, com uma alta de 12% na demanda. Esse aumento é impulsionado por diversos setores-chave da economia, como a...

-

Queda na Produção e Consumo da Siderurgia Brasileira em Março

Em março de 2025, a indústria siderúrgica brasileira enfrentou um período desafiador, com uma queda significativa tanto na produção quanto no consumo de aço. Os dados revelam que a produção de aço ...

-

Confiança da indústria brasileira atinge o menor nível desde 2020

Em 2025, a confiança dos industriais brasileiros atingiu o menor patamar desde 2020, de acordo com uma pesquisa realizada pela Confederação Nacional da Indústria (CNI). Esse cenário reflete as ince...

-

Exportação de Equipamentos Agrícolas cresce 15% com destaque para Componentes em Aço

O Brasil registra um aumento expressivo na exportação de máquinas e equipamentos agrícolas, especialmente aqueles que utilizam componentes em aço de alta performance, atendendo à demanda global por...

-

Aço e alumínio respondem por quase 40% das exportações brasileiras para os EUA em 2025

Nos três primeiros meses de 2025, 47,5% do valor das exportações brasileiras de aço e alumínio foram destinados aos Estados Unidos. Apesar da tarifa de 25% imposta pelo governo americano, o setor s...

-

Indústria brasileira aposta no diálogo para reverter taxação do aço nos EUA

A indústria brasileira de aço está confiante de que o diálogo com o governo dos Estados Unidos pode reverter a recente imposição de uma tarifa de 25% sobre as exportações de aço brasileiro para o p...

-

Brasil tem impactos Negativos e Positivos com as tarifas entre EUA e China

Consequências para o Brasil e os principais setores atingidos pelas tarifas impostas entre Estados Unidos e China

A guerra comercial travada entre Estados Unidos e China, com imposição mútua de tar...

-

Tarifas entre EUA e China: Setores atigindos e Impactos Econômicos

A guerra comercial entre Estados Unidos e China representa uma das mais intensas disputas econômicas da história moderna. Com a imposição de tarifas altíssimas sobre produtos importados, tanto os E...

-

Inovações em Ferramentas Agrícolas com Aço

A agricultura moderna depende cada vez mais de ferramentas eficientes e duráveis para garantir a produtividade e o sucesso das operações no campo. Nesse contexto, o aço tem se destacado como um mat...

-

Agricultura 5.0: Revolução Tecnológica no Campo

A agricultura, ao longo dos séculos, tem passado por transformações significativas, impulsionadas pela evolução tecnológica. Desde a mecanização da lavoura até a introdução de técnicas de precisão,...

-

Aço no Agronegócio - Equipamentos, Armazenagem, Maquinário e Inovação

O aço é um material fundamental no agronegócio, desempenhando um papel crucial em diversas aplicações. Sua resistência, durabilidade e versatilidade o tornam indispensável para a indústria agrícola...

-

Estruturas de Armazenagem em Aço que transformam o Agronegócio

O agronegócio é um setor fundamental para a economia global, responsável por alimentar bilhões de pessoas em todo o mundo. Nesse contexto, as estruturas de armazenagem em aço desempenham um papel c...

-

Importações Brasileiras de Aço Devem Crescer em 2025

De acordo com o Instituto Nacional dos Distribuidores de Aço (INDA), as importações brasileiras de aço devem crescer cerca de 11% em 2025. Esse aumento é impulsionado pela competitividade do mercad...

-

Nova Política Industrial Brasileira Impulsiona o Mercado Nacional de Aço Inoxidável

O Brasil, em 2023, lançou a Nova Indústria Brasil (NIB), uma política industrial ambiciosa voltada para a inovação e a sustentabilidade até 2033. Essa iniciativa tem tido um impacto significativo e...

-

Indústria do Aço enfrenta Desafios em 2025: Queda na Produção e Vendas Projetada

A indústria siderúrgica brasileira enfrenta um cenário desafiador em 2025, com projeções de queda na produção de aço bruto e nas exportações de laminados. De acordo com as estimativas, a produção d...

-

A Indústria Brasileira enfrenta desafios em meio a uma demanda mais fraca

A indústria brasileira, incluindo o setor siderúrgico, está enfrentando uma demanda mais fraca do que o esperado. Os dados mostram que a produção de aço no Brasil caiu 1,6% em fevereiro em relação ...

-

Tarifas de 25% sobre Aço e Alumínio nos EUA: Impactos para o Brasil

Em março de 2025, o governo dos Estados Unidos implementou tarifas de 25% sobre todas as importações de aço e alumínio. Essa medida teve um impacto significativo no Brasil, que é o segundo maior fo...

-

Produção de Aço no Brasil registra crescimento em Fevereiro de 2025

A indústria siderúrgica brasileira deu sinais de recuperação em fevereiro de 2025, com a produção de aço bruto atingindo 2,7 milhões de toneladas, um aumento em relação às 2,6 milhões de toneladas ...

-

Brasil Planeja Investir US$ 20 Bilhões na Expansão do Setor Siderúrgico

O setor siderúrgico brasileiro anunciou planos ambiciosos para investir US$ 20 bilhões em projetos de expansão e modernização até 2030. Essa iniciativa visa posicionar o Brasil como líder na produç...

-

Setor Automotivo impulsiona demanda por Aço no Brasil

O setor automotivo brasileiro vem registrando um crescimento significativo nos últimos anos, impulsionando a demanda por aço laminado e componentes estruturais utilizados na fabricação de veículos....

-

Indústria Brasileira acredita em diálogo para reverter Taxação do Aço

A indústria brasileira está confiante de que o diálogo com os Estados Unidos pode reverter a recente taxação de 25% sobre as exportações de aço do Brasil para o mercado americano. Essa medida, anun...

-

7 Medidas do Governo para mitigar os Efeitos da Selic Alta no Setor Industrial

Em 2025, o cenário econômico brasileiro é marcado por uma Selic (taxa básica de juros) elevada, impactando diretamente o setor industrial. Diante desse desafio, o governo federal tem buscado implem...

-

Redução da Produção de Aço na China impacta nas Mineradoras Brasileiras

A redução da produção de aço na China está impactando as mineradoras brasileiras de várias maneiras. Como o maior consumidor de minério de ferro do mundo, a queda na produção siderúrgica chinesa si...

-

Como o Controle dos Gastos Públicos beneficia diferentes Setores Industriais

O controle dos gastos públicos é um tema recorrente nas discussões sobre políticas econômicas. Embora muitas vezes visto como uma medida restritiva, essa abordagem pode trazer benefícios significat...

-

Desaceleração no Custo da Construção: Análise do INCC-M

O setor da construção civil é um importante motor da economia brasileira, com impactos significativos em diversos segmentos industriais. Nesse contexto, o acompanhamento dos índices de custo da con...

-

Expansão do Porto de Paranaguá: Aumento de Capacidade e Impacto no Agronegócio Brasileiro

O Porto de Paranaguá, localizado no sul do Brasil, desempenha um papel fundamental no escoamento da produção agrícola do país. Recentemente, a administração portuária anunciou uma importante expans...

-

Prioridades da Indústria para o Congresso: Licenciamento Ambiental, Economia Circular e Inteligência Artificial

A indústria brasileira apresentou suas principais prioridades ao Congresso Nacional, destacando três temas fundamentais para impulsionar a competitividade e a sustentabilidade do setor nos próximos...

-

CMA CGM recebe Primeiro Navio Movido a Metanol

O grupo CMA CGM, um dos principais operadores de transporte marítimo do mundo, acaba de receber seu primeiro navio porta-contêineres movido a metanol. Essa inovação representa um marco importante n...

-

Brasil lidera Exportações Globais de Commodities Agrícolas

O Brasil se estabeleceu como o principal exportador mundial de commodities agrícolas, superando os Estados Unidos neste segmento. Esse crescimento expressivo nas exportações do agronegócio brasilei...

-

Confiança da Indústria Estável: Análise do Índice de Confiança da Indústria (ICI) do FGV IBRE

O Índice de Confiança da Indústria (ICI) do FGV IBRE permaneceu estável em março, com uma leve variação de 0,1 ponto, alcançando 98,4. Essa estabilidade sugere que as expectativas dos empresários e...

-

Mercado de Aço em 2025: Uma Visão Geral

O mercado de aço no mundo está passando por um período de ajustes, com influências significativas na demanda e nos preços. Aqui está uma visão geral da situação atual:

Demanda de Aço

Crescimento Gl...

-

Importância da Indústria na Economia Global

A economia da indústria é um setor vital que transforma matérias-primas em bens e serviços, desempenhando um papel fundamental na produção e no fornecimento de empregos em todo o mundo. Ela é class...

-

Principais Indústrias que impulsionam a Economia Brasileira

As maiores indústrias do Brasil são líderes em seus respectivos setores e desempenham um papel crucial na economia nacional. Elas variam desde a indústria de petróleo e gás até a siderurgia, alimen...

-

Complexo Industrial do ABCD: O Coração Batente da Indústria Brasileira

O Complexo Industrial do ABCD, localizado na região metropolitana de São Paulo, é reconhecido como o maior polo industrial do Brasil. Abrangendo os municípios de Santo André, São Bernardo do Campo,...

-

Região Sudeste: O Coração Industrial do Brasil

A região Sudeste do Brasil é indiscutivelmente o coração industrial do país. Abrangendo os estados de Minas Gerais, Espírito Santo, Rio de Janeiro e São Paulo, essa área geográfica concentra a maio...

-

Industrialização Tardia e seus Desafios

A industrialização tardia é um fenômeno complexo que tem marcado o desenvolvimento econômico de muitos países em todo o mundo. Esse processo, caracterizado pela dependência tecnológica, investiment...