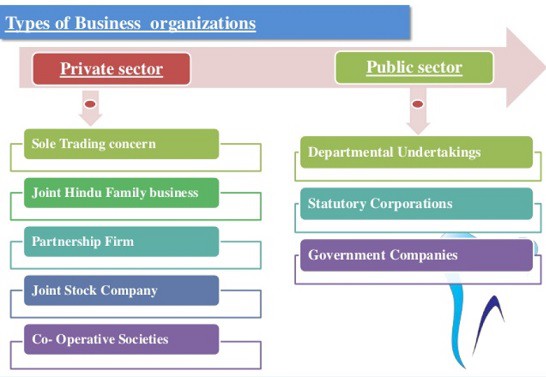

When organizing a new business, one of the most important decisions to be made is choosing the business structure.

a) Individual Company

The vast majority of small businesses start as sole proprietorships. . . very dangerous. These companies are owned by one person, usually the individual who has day-to-day responsibility for running the business. Individual owners own all of the company's assets and profits

generated by it. They also take “fully personal” responsibility for all of your liabilities or debts. In the eyes of the law, you are the same as the business.

Merits:

• Easiest and least expensive form of ownership to organize.

• Individual owners have full control, within the law, to make all decisions.

• Individual entrepreneurs receive all income generated by the business to maintain or reinvest.

• Business profits flow directly to the owner's personal income tax return.

• The business is easy to dissolve if desired.

Demerits:

• Unlimited liability and are legally responsible for all debts against the company.

• Your business and personal assets are 100% at risk.

• Almost managed to raise investment funds.

• They are limited to using personal savings funds or consumer loans.

• Have difficulty attracting high caliber employees or those who are motivated by the opportunity to own a part of the business.

• Employee benefits, such as owner's medical insurance premiums, are not directly deductible from business income (partially deductible as an adjustment to income).

types of business organization

types of business organization b) Partnerships

In a Partnership, two or more people share ownership of a single business. Just like properties, the law does not distinguish between the company and its owners. Partners must have a legal agreement that sets out how decisions will be made, profits will be shared, disputes will be resolved, how future partners will be admitted into the partnership, how partners can be bought out, or what steps will be taken to dissolve the partnership when necessary. Yes, it is difficult to think about a “break-up” when the business is just starting out, but many partnerships break down in times of crisis and, unless there is a defined process, there will be even bigger problems. They must also decide in advance how much time and capital each will contribute, etc.

Merits:

• Partnerships are relatively easy to establish; however, time must be invested in developing the partnership agreement.

• With more than one owner, the ability to raise funds can be increased.

• Business profits flow directly into partners' personal taxes.

• Potential employees may be attracted to the business if they are given the incentive to become partners.

Demerits:

• Partners are jointly and individually responsible for the actions of the other partners.

• Profits must be shared with others.

• As decisions are shared, disagreements may occur.

• Some employee benefits are not deductible from business income on tax returns.

• Partnerships have a limited lifespan; it can end with the withdrawal or death of the partner.

c) Corporations

A corporation, chartered by the state in which it is headquartered, is considered by law to be a unique “entity,” separate and apart from those who own it. A company can be taxed; can be processed; may enter into contractual agreements. The owners of a company are its shareholders. Shareholders elect a board of directors to oversee key policies and decisions. The corporation has a life of its own and does not dissolve when ownership changes.

Merits:

• Shareholders have limited liability for the corporation's debts or judgments against corporations.

• Generally, shareholders can only be held responsible for their investment in company shares. (Note, however, that officers can be held personally liable for their actions, such as failure to withhold and pay employment taxes.)

• Companies can raise additional funds by selling shares. A company can deduct the cost of benefits it offers to managers and employees.

• May elect S corporation status if certain requirements are met. This election allows the company to be taxed similar to a partnership.

Demerits:

• The incorporation process requires more time and money than other forms of organization.

• Businesses are monitored by federal, state, and some local agencies and, as a result, may have more documentation to comply with regulations.

• Incorporation may result in higher overall taxes. Dividends paid to shareholders are not deductible from corporate income, so this income may be taxed twice.

d) Joint Stock Company:

The limited financial resources and heavy risk burden involved in both previous forms of organization have led to the formation of joint-stock companies, which have limited diluters. Capital is raised by selling shares of different values. The people who buy the shares are called shareholders. The managing entity known as; Board of Directors; is responsible for making important political and financial decisions.

There are two main types of joint stock companies.

(i) Limited liability company.

(ii) Public limited company

(i) Limited Company:

This type of company can be formed by two or more people. The maximum number of members is limited to 50. In this case, the transfer of shares is limited to members only. The government also does not interfere in the operation of the company.

(ii) Public Limited Company:

It is one whose membership is open to the general public. The minimum number required to form such a company is seven, but there is no maximum limit. These companies may advertise to offer their shareholding to the general public through a prospectus. These public limited companies are subject to greater control and oversight.

Merits:

• As the liability is limited, the shareholder will not have any risk and therefore, people will be encouraged to invest capital.

• Due to the large number of investors, the risk of loss is shared.

• Public limited companies are not affected by the death or retirement of shareholders.

Disadvantages:

• It is difficult to preserve confidentiality in these companies.

• Requires compliance with a large number of legal formalities.

• Lack of personal interest.

e) Public Companies:

A public company is wholly owned by the government, from center to state. It is generally established by a Special Law of parliament. The special statute also prescribes its power duties and management standard jurisdictions. Although the entire capital is provided by the Government, they have a separate entity and enjoy independence in matters relating to appointments, promotions, etc.

Merits:

• These are expected to provide better working conditions for employees and are supported to be better managed.

• Quick decisions may be possible due to the absence of bureaucratic control.

• More hexibility compared to departmental organization.

• Since management is in the hands of experienced and capable directors and managers, they are managed more efficiently than government departments.

Demerits:

• Any change in the power and Constitution of the Corporation requires a change in the specific law, which is difficult and time-consuming.

• Public companies have a monopoly and, in the absence of competition, they are not

interested in adopting new techniques and improving their work.

f) Government Companies:

A state-owned company can also be organized as a joint-stock company; A government company is any company whose share capital is held by the central government or partly by the central government and one or more state governments. It is managed by

elected board of directors, which may include natural persons. These are responsible for their work to the concerned ministry or department and their annual report must be placed every year on the table of the parliament or state legislatures along with the government's comments to the concerned department.

Merits:

• It is easy to form.

• Directors of a government company are free to make decisions and are not bound by

certain strict rules and regulations.

Demerits:

• Abuse of excessive freedom cannot be excluded.